I'm not cooking dinner tonight - $128k daily realized gain

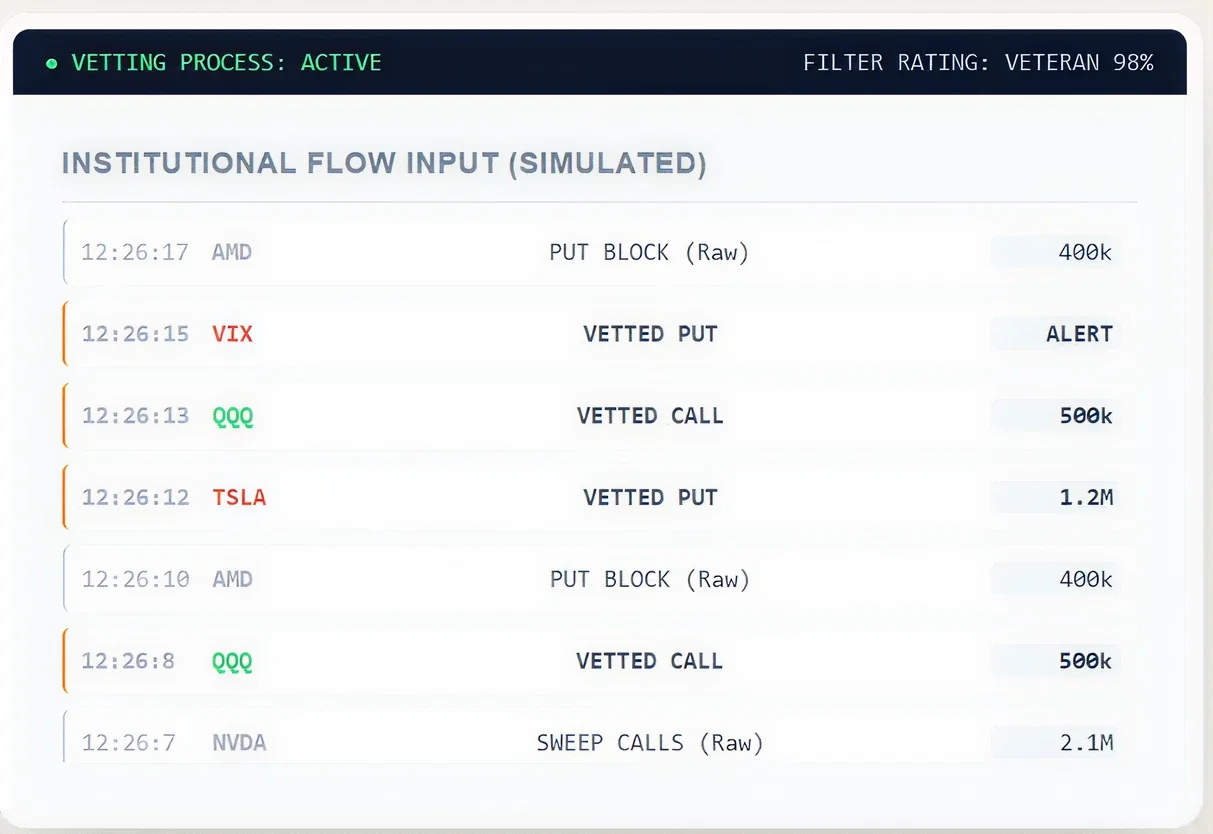

FILTERED INSTITUTIONAL FLOW

Most traders lose because they can’t spot the correct trades. We provide the focus, the context, and the veteran vetting you need to trade with conviction.

Standard flow services show you everything—which means you see nothing. Our expertise cuts

through the blur to find the flow intention.

High Conviction

$WRBY 9x Daily Volume Endless alerts that lead to over-trading and confusion.

Endless alerts that lead to over-trading and confusion.

‘Tied’ orders that are not as special as they appear.

‘Tied’ orders that are not as special as they appear.

Gamma calculations that inaccurately map levels

Gamma calculations that inaccurately map levels

Veteran deciphering of flow intention.

Veteran deciphering of flow intention.

Full transparency around flow meaning.

Full transparency around flow meaning.

Institutional GEX for a definitive map of levels.

Institutional GEX for a definitive map of levels.

Access the authority. Our founders are not analysts, they are veteran traders whose job is to

filter the market noise for you.

Access the authority. Our founders are not analysts, they are veteran traders whose job is to

filter the market noise for you.

Access 3 streaming squawks and news text for immediate news trades.

Trade ideas and positions from the community called out and flagged.

From GEX, Flow, Trades, and more, TFL aligns traders to high probability outcomes.

A curated set of tools to plan, execute, and review trades efficiently.

Structured level maps and contextual notes to support bias and risk control.

Quick-view dashboards for signals, positioning, and daily market conditions.

Get guidance from veterans and seasoned members for faster skill growth.

Real-time discussion and Q&A to keep you aligned during market hours.

Searchable resources, playbooks, and recordings for continuous improvement.

Cut through market noise with expert-vetted GEX and real order-flow insight. Make confident

trade decisions backed by dealer-level context, not guesswork.

Clear answers to the most common questions about our analysis, vetting process, and how to

get started—so you can trade with confidence and clarity.

GEX (Gamma Exposure) analysis identifies where dealer positioning and liquidity are likely to influence price movement.

Our team reviews each callout for context, confirmation, and risk alignment before it’s shared.

Veteran traders and senior moderators review ideas, add context, and flag the highest-conviction setups.

Yes—our framework supports beginners through advanced traders by focusing on context, levels, and process.

We cover major indices and liquid names where flow, positioning, and options structure provide clear signals.

We update daily during market sessions, with additional notes around major events and volatility shifts.

All insights are expert-reviewed. Data models assist the process, but every analysis is manually vetted for accuracy & relevance. The automated charts are done based on our breakout criteria.

You get context, levels, and intention—so you can hold winners longer and avoid low-quality trades.

Yes. We encourage all Members to submit ideas and also ask questions. We have a channel dedicated to reviewing trades to learn more and understand what a person saw in a trade.

Choose your plan, join the community, and log into the Discord. We have vidoes to help navigate and understand the room as well as channels to get your oriented and running.

Have a questions? Fill out the form and our team will get back to you with the right guidance, quickly and clearly.